(Chicago, IL) – In the latest setback for Chicago Mayor Brandon Johnson, a Cook County judge ruled on February 23rd that Johnson’s Mansion Tax was unconstitutional. The ruling, delivered by Judge Kathleen Burke, determined the proposed referendum violates state law by asking for both a tax cut and a tax hike in the same question, consequently ordering its removal from the March 19 primary ballot in Chicago.

The “Bring Chicago Home” proposal by the Johnson administration, aimed to adjust the tax imposed on real estate sales with the promise of raising $100 million annually for homeless relief efforts. However, details regarding how these funds would effectively mitigate homelessness remained vague.

Under the proposed plan, properties selling for less than $1 million would see a slight tax cut, while taxes for properties selling between $1 million to $1.5 million would triple, and those selling above $1.5 million would face quadruple taxation. The majority of properties affected by the proposed tax increase are commercial rather than residential, by a ratio of 9-to-1.

Diverting additional funds through burdensome taxation disproportionately impacts small businesses and property owners, hindering economic growth and job creation. Los Angeles enacted a similar measure and the projected revenue fell short of expectations while at the same time burdening commercial and rental property owners.

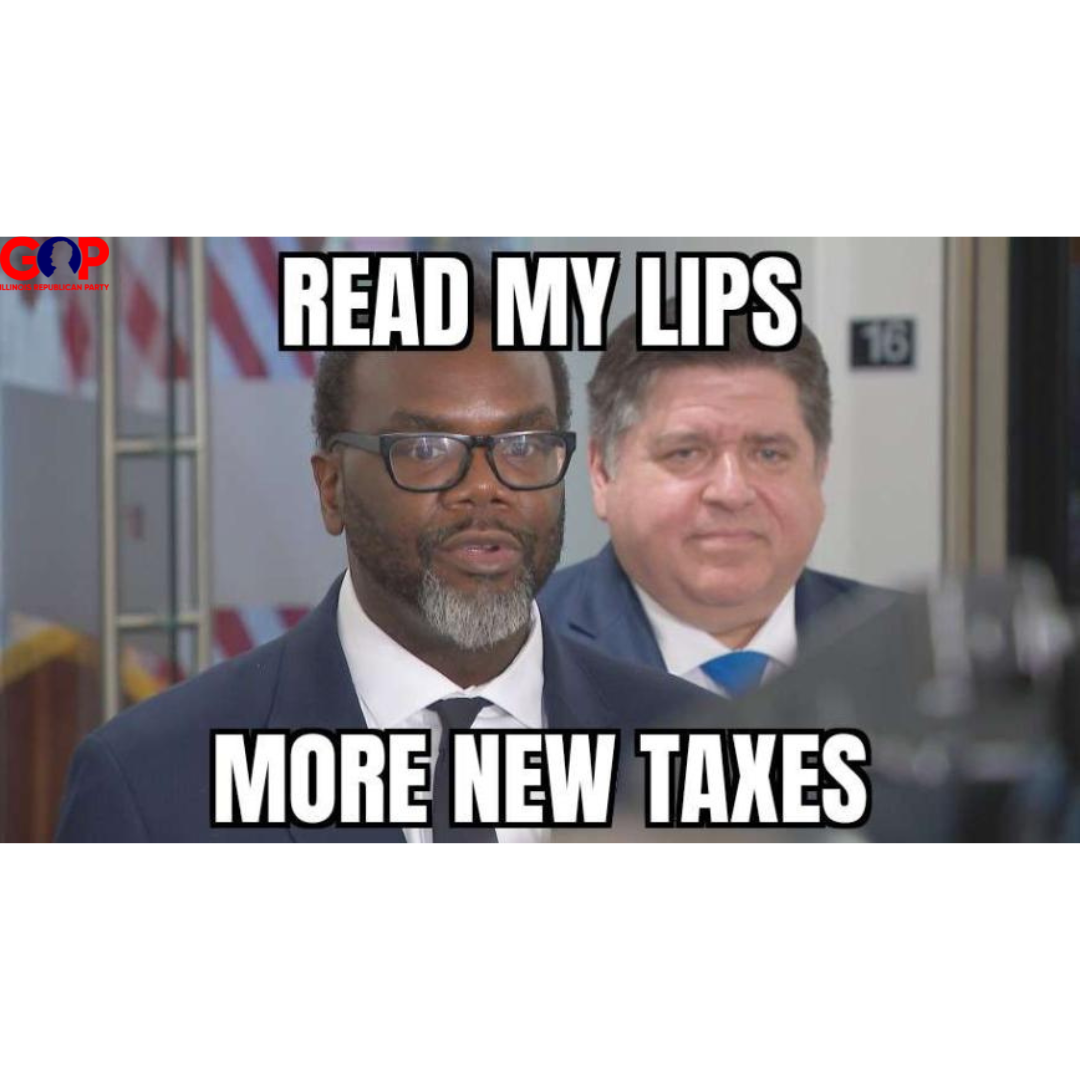

“This ruling is a victory for taxpayers and small businesses across Chicago who would have borne the brunt of Mayor Johnson’s unconstitutional and misguided Mansion Tax proposal,” said Don Tracy, Illinois Republican Party Chairman. “It would have been the same story of Democrat policies that burden hardworking citizens with excessive taxation and hinder economic growth. We must be fiscally responsible and encourage entrepreneurship to truly serve the people of Chicago and Illinois.”